Đánh giá Oura Ring – Chiếc nhẫn “kỳ diệu” tại Việt Nam

Cái nhìn tổng quan về Oura Ring

Trong thời đại công nghệ phát triển như hiện nay, việc theo dõi và chăm sóc sức khỏe cá nhân đã trở thành một phần thiết yếu trong cuộc sống hàng ngày. Khác với các đồng hồ thông minh truyền thống, Oura Ring đã gây ấn tượng lớn nhờ thiết kế tinh tế và tính năng theo dõi sức khỏe vượt trội. Mặc dù sản phẩm này từng là tâm điểm trong thị trường thiết bị đeo thông minh, hiện tại Oura Ring phải đối mặt với thách thức về sự phổ biến. Bạn có thể tìm hiểu thêm về Oura Ring tại trang chủ Oura.

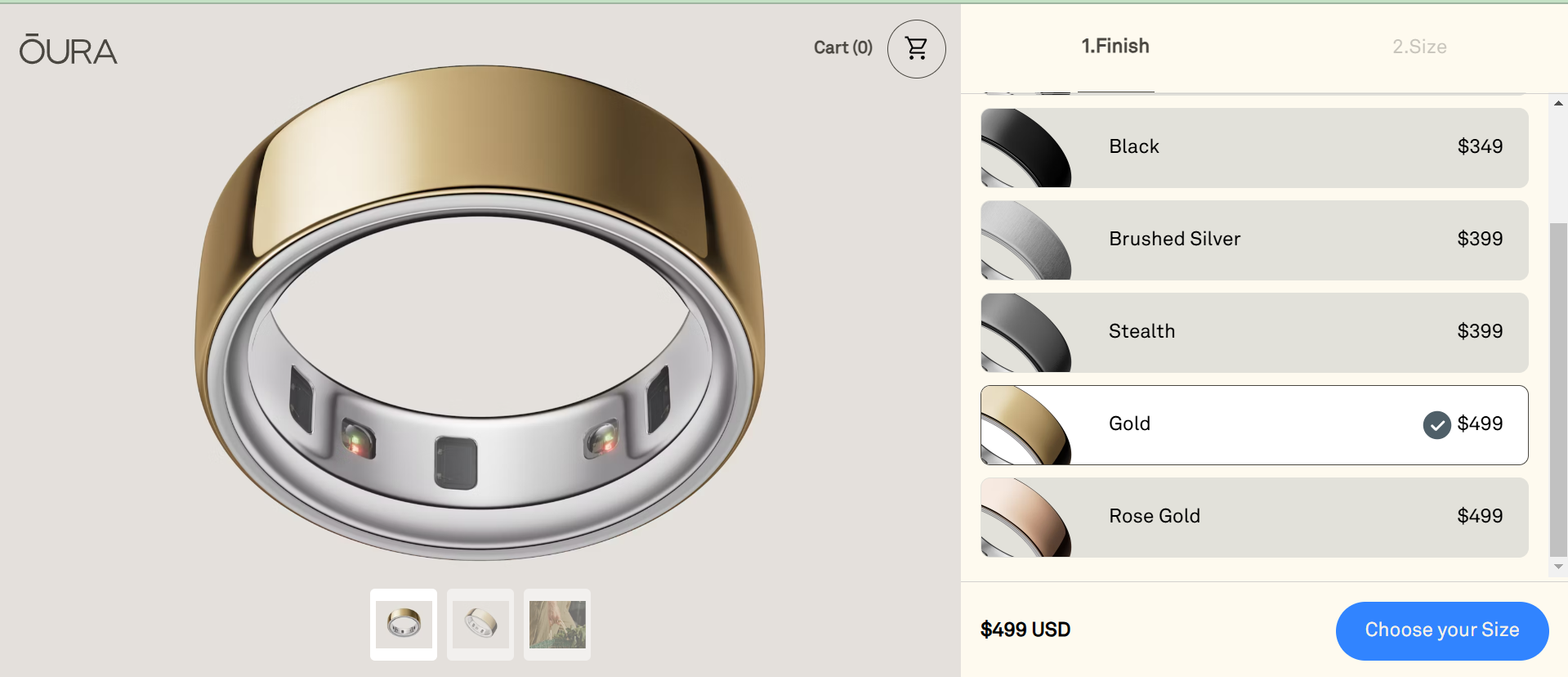

Sản phẩm này hiện có giá khoảng 499 USD.

Thiết kế ấn tượng của Oura Ring

Oura Ring tự hào với thiết kế hiện đại, phù hợp cho cả nam và nữ. Phiên bản Heritage với lớp titan phủ PVD mang đến một vẻ đẹp sang trọng nhưng vẫn đơn giản. Với trọng lượng chỉ khoảng 5 gram và độ dày 2.55mm, chiếc nhẫn này rất thoải mái để đeo cả ngày lẫn đêm.

Chất liệu chống nước và chống trầy xước của Oura Ring đảm bảo cho sản phẩm bền bỉ trong mọi hoạt động hàng ngày. Đặc biệt, lớp lót bên trong được làm từ chất liệu không gây kích ứng da, làm cho chiếc nhẫn này trở thành lựa chọn lý tưởng cho những ai có làn da nhạy cảm.

Lưu ý khi chọn kích thước:

Oura cung cấp bộ nhẫn thử miễn phí, giúp người dùng chọn kích thước phù hợp nhất. Hãy chọn một kích thước thoải mái để tránh cảm giác chật chội khi thời tiết nóng bức.

Trải nghiệm đeo Oura Ring hàng ngày

Oura Ring mang đến cảm giác thoải mái tuyệt vời khi đeo. Bạn có thể làm việc, tắm và thậm chí ngủ mà không cần tháo nhẫn. Tuy nhiên, một nhược điểm lớn là khả năng tìm kiếm nhẫn khi quên đeo lại khá khó khăn do thiết kế nhỏ gọn. Nhẫn cũng không có âm thanh hoặc rung để cảnh báo khi bị bỏ quên.

Cảm biến và ứng dụng trên Oura Ring

Theo dõi giấc ngủ – Tính năng cốt lõi

Oura Ring nổi bật với khả năng theo dõi giấc ngủ chi tiết. Các cảm biến quang học PPG và nhiệt độ NTC giúp thu thập dữ liệu về nhịp tim, nhịp thở và nhiệt độ cơ thể một cách chính xác. Bạn chỉ cần đeo nhẫn khi ngủ và ứng dụng sẽ xử lý tất cả dữ liệu.

Hạn chế trong theo dõi hoạt động

Tuy nhiên, mặc dù Oura Ring có khả năng đếm bước và ghi lại các hoạt động cơ bản, nhưng tính năng theo dõi thể thao lại thiếu. Điều này khiến sản phẩm không thể cạnh tranh với các đồng hồ thông minh chuyên dụng cho người dùng thể dục.

Pin và cách sạc

Oura Ring gây ấn tượng với thời lượng pin khoảng một tuần cho mỗi lần sạc. Giá đỡ sạc thông minh giữ chắc chiếc nhẫn trong suốt quá trình sạc, rất thuận tiện cho những người bận rộn.

Ai nên mua Oura Ring?

Ưu điểm:

- Theo dõi giấc ngủ chuyên sâu: Cung cấp dữ liệu chi tiết giúp cải thiện thói quen ngủ.

- Thiết kế thời trang: Oura Ring không chỉ là một thiết bị công nghệ mà còn là món trang sức thời thượng.

- Thời lượng pin dài: Giảm tần suất sạc cho người sử dụng.

Nhược điểm:

- Giá thành cao: Oura Ring có mức giá cao so với các đồng hồ thông minh và vòng tay thể dục khác.

- Khả năng theo dõi vận động yếu: Không đề xuất cho những ai cần các phân tích thể thao chuyên sâu.

Nếu bạn đang tìm kiếm một thiết bị thời trang để theo dõi giấc ngủ và sức khỏe cơ bản, Oura Ring là lựa chọn hoàn hảo. Tuy nhiên, nếu mục tiêu của bạn là hỗ trợ luyện tập thể dục, hãy cân nhắc các thiết bị khác như Apple Watch hay Garmin.

Cảm nghĩ cuối cùng

Oura Ring là minh chứng cho sự giao thoa giữa công nghệ và thời trang. Mặc dù không phải là thiết bị theo dõi sức khỏe toàn diện, nhưng chiếc nhẫn này mang đến giá trị lớn trong việc theo dõi giấc ngủ và sức khỏe. Nếu bạn sẵn sàng chấp nhận mức giá và những giới hạn tính năng, Oura Ring sẽ là một món đồ trang sức công nghệ xứng đáng để đầu tư.

Câu hỏi thường gặp về Oura Ring

-

Oura Ring có chống nước không?

- Có, bạn có thể đeo khi rửa tay hoặc tắm, nhưng không nên đeo khi lặn sâu.

-

Thời lượng pin của Oura Ring là bao lâu?

- Khoảng 7 ngày với một lần sạc đầy.

-

Oura Ring có đo được nhịp tim không?

- Có, nhưng chỉ đo khi bạn nghỉ ngơi.

-

Oura Ring có hỗ trợ thanh toán không?

- Không, Oura Ring không tích hợp chức năng thanh toán.

- Oura Ring có phù hợp để làm quà tặng không?

- Rất phù hợp, đặc biệt cho những ai quan tâm đến sức khỏe và công nghệ.

Khám Phá Oura Ring để nâng cao chất lượng cuộc sống và theo dõi sức khỏe của bạn một cách thông minh và tinh tế ngay hôm nay!

Nguồn Bài Viết Review oura Ring – Chiếc nhẫn “kỳ diệu”